Now, v4 changes so it design having a great singleton framework, where all the pools perform within one offer. Prior to v4, Uniswap set the rules, and builders can only explore its predefined design. Today, they’re able to do personalized models out of Uniswap, developing exchangeability pools to complement certain needs.

Fee range | Uniswap exchange

- To learn the significance of V4, it’s necessary to go through the travel of Uniswap from V1 in order to V4.

- With Uniswap V4 and features for example Hooks, let us talk about just how which DeFi leader continues on moving the fresh limitations of what is actually you are able to.

- Huge sales are therefore far more costly than just reduced requests and you may usually lead to progressively higher slippage.

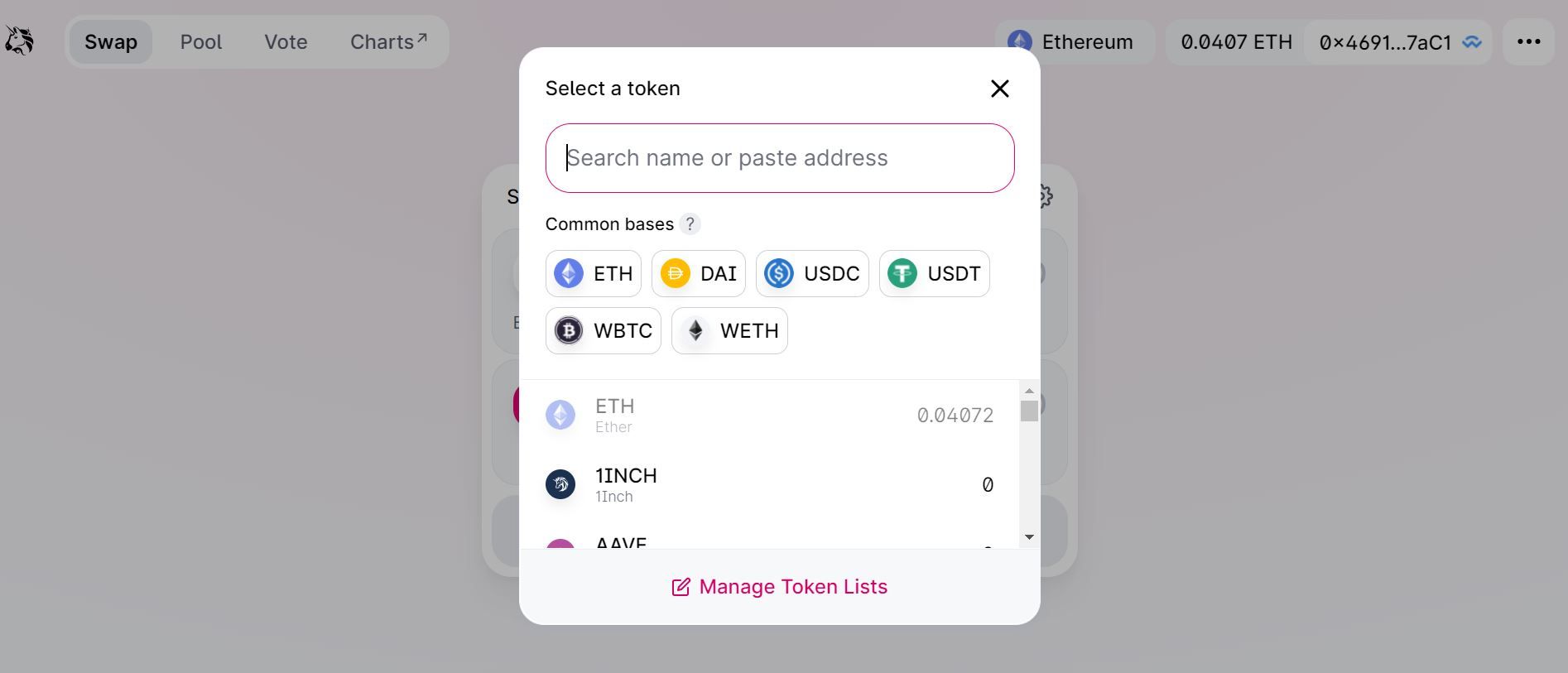

- Inside the earlier versions, Uniswap V2 and you may V3, the new process necessary users to help you tie their ETH on the Wrapped Ether (WETH) before doing positions.

- Uniswap v4 isn’t simply an improvement—it’s a basic renovate away from decentralized transfers.

When you’re Uniswap retains its prominence out of EVM communities, battle try intensifying to the development of most Uniswap exchange other ecosystems for example Solana, which can be attracting expanding trading volumes. While you are Uniswap not consistently takes up the top location in terms of regularity, they holds its position in the finest step 3. The fresh exchangeability amendment hooks are granular for protection aim. Very in public accessible segments play with a main restriction purchase publication layout out of change, where people and you will providers create orders arranged because of the rates height one is actually progressively occupied while the demand shifts.

Customers Achievement and you may Service

Uniswap has been through some iterations, starting Uniswap V2 inside 2020 and you can Uniswap V3 in the 2021. Inside the Summer 2023, Uniswap put-out the newest draft code to own Uniswap V4, that has significant the newest functionalities. DEXs provide book pros that will make them a persuasive alternative to CEX. Developed by Hayden Adams inside 2018, its implementation is driven from the root tech basic explained by the Ethereum co-creator Vitalik Buterin.

Flash Accounting

Uniswap V4 lets users to help make liquidity pools rather than permission, providing the new trading locations and individualized liquidity steps. Personalized bookkeeping allows designers to modify token balance during the exchanges and you will liquidity incidents, overriding the newest standard concentrated liquidity design. This enables detachment costs, option AMM contours, and you will designed LP prize formations. Uniswap developed the brand new Automated Business Founder (AMM) design, replacement old-fashioned order courses which have associate-funded liquidity swimming pools and prices algorithms. As of 2024, Uniswap has processed over 465 million deals and most $dos.5 trillion inside collective volume.

Render Liquidity

Inside the Uniswap V3, an alternative offer is implemented per liquidity pond, to make doing swimming pools and you may carrying out multi-pool exchanges more pricey. The newest discharge of the new UNI governance token have next founded Uniswap’s status while the a residential area-determined platform. As the DeFi environment is growing, it might be fascinating observe how DEXs develop to fulfill representative demands while keeping the core thinking of decentralization.

Uniswap v4 is positioned to support features including to your-strings limitation orders and you can dynamic charges, therefore it is more strong. It model promises liquidity (as long as the brand new pool try funded) and democratizes business-making; users can become LPs and secure change charge without having to be elite group people. Pages, named liquidity company (LPs), deposit equivalent values out of both tokens to your pool.

Accepting Ethereum’s scaling restrictions, Uniswap has grown to numerous Coating 2 and you may choice blockchains, along with Arbitrum, Optimism, Polygon, Ft, and you may BNB Chain. So it dramatically decrease energy costs and you may grows access to to have reduced buyers and you will high-frequency pages. Bringing exchangeability inside the Uniswap V4 are orchestrated from the PoolManager deal via the modifyLiquidity disperse.

The result is one to one money couple have an endless level of pools by the specifying additional percentage and/otherwise hook up settings. Therefore, V4 no more aids for the-strings enumeration of pools, very indexing of your Initialize knowledge grows more important. Slated to help you launch immediately after Ethereum’s Cancun-Deneb upgrade, Uniswap v4 usually discover modular exchangeability thanks to “hooks,” permitting developers do dynamic commission patterns, on-chain limit orders, and automatic rebalancing. Moreover it brings up a singleton buildings and you can flash bookkeeping, significantly cutting gasoline use. V4 is determined to reshape DeFi composability to make liquidity provisioning much more personalized.

We’re launching the new draft code today to ensure v4 is also be manufactured in societal, that have discover views and important area contribution. Look for the new open-acquired, early sort of the fresh Uniswap v4 core and you can periphery repositories, check out the write tech whitepaper right here, and find out about how to contribute right here. That’s why we have been very happy to expose all of our sight to possess Uniswap v4, which we believe tend to open an environment of options for just how liquidity is done and how tokens is actually traded onchain.

The new the amount from voting electricity a person features is actually proportional so you can how many governance tokens they keep. The newest governance techniques is decentralized, and therefore you can now fill in an offer and you may you can now vote. Uniswap has evolved over time, with different method brands giving new features and you may developments.

That it optimization streamlines deals and you will advances results, making DeFi a lot more costs-effective to possess users and you can exchangeability organization. One of the most epic designs of the Uniswap V4 try “hooks.” Essentially, hooks try personalized wise contracts which can be put in liquidity swimming pools. This allows adjustment including nothing you’ve seen prior, strengthening developers to make usage of certain functionalities at the additional things inside the a pool’s lifecycle, before otherwise after swaps otherwise exchangeability change.

It independency facilitates better made exchange delivery and you will makes it possible for best alteration from the periphery. Note that ERC-6909 tokens do not currently have lead help from inside the new V4Router but that is hit using Tips constants and that is apt to be extra in the future. Rather than V3, Uniswap V4 positions try uniquely identified through the use of a great salt factor which makes for each liquidity reputation distinctive line of. In past times, a few depositors inside the exact same exchangeability assortment common pond state while the a fuel optimisation, however, V4 isolates her or him to possess better adjustment and you will recording. Inside V4, only the token id and you can root details are stored that will up coming be used to ask the newest PoolManager individually. Users still need to shell out fuel less than certain items, such as to the first token approval out of Permit2.